Home / News & Insights / March 15, 2021 / ...

The Psychology of Collections

Effective communication with a variety of people is an essential component of successful debt recovery. It is vital to achieving a positive outcome for all parties involved. For you that means collecting all that can be collected while maintaining positive client relations; for the debtor it means avoiding the potential consequences associated with further debt evasion. To achieve this goal, it is important to understand what people are thinking and feeling so you can help guide their decisions to a constructive conclusion.

Why debtors refuse to engage

Convincing the debtor that they need to engage in negotiation is often the first hurdle. Debtors are frequently unwilling to take your call or respond to an email so it can be useful to understand why they are refusing to communicate.

Fear is a major driver. Debtors may be scared of what lies ahead, preferring ignorance or denying knowledge of the problem. They believe that if they can avoid their obligation, they are protected from any consequences.

Some debtors are complacent and simply don’t care about their predicament. Many, however, will refuse your calls, and delete your emails in an attempt to hide the full details of their situation. They believe secrecy is a form of protection.

To engage with an elusive debtor, it can be useful to catch them off guard. Calling on a number they do not expect you to use, or at an unusual time, may help sidestep some of these barriers.

Once you have your debtor on the line, there are three key ideas you need to imprint firmly in their mind.

First and foremost, stress that the debt is important and will not be overlooked or forgotten. Be clear that by paying the outstanding balance now, they can avoid an escalation of consequences in the future. Finally, emphasize that you are an experienced collections professional and that you are committed to securing payment.

Guiding debtors to a successful outcome

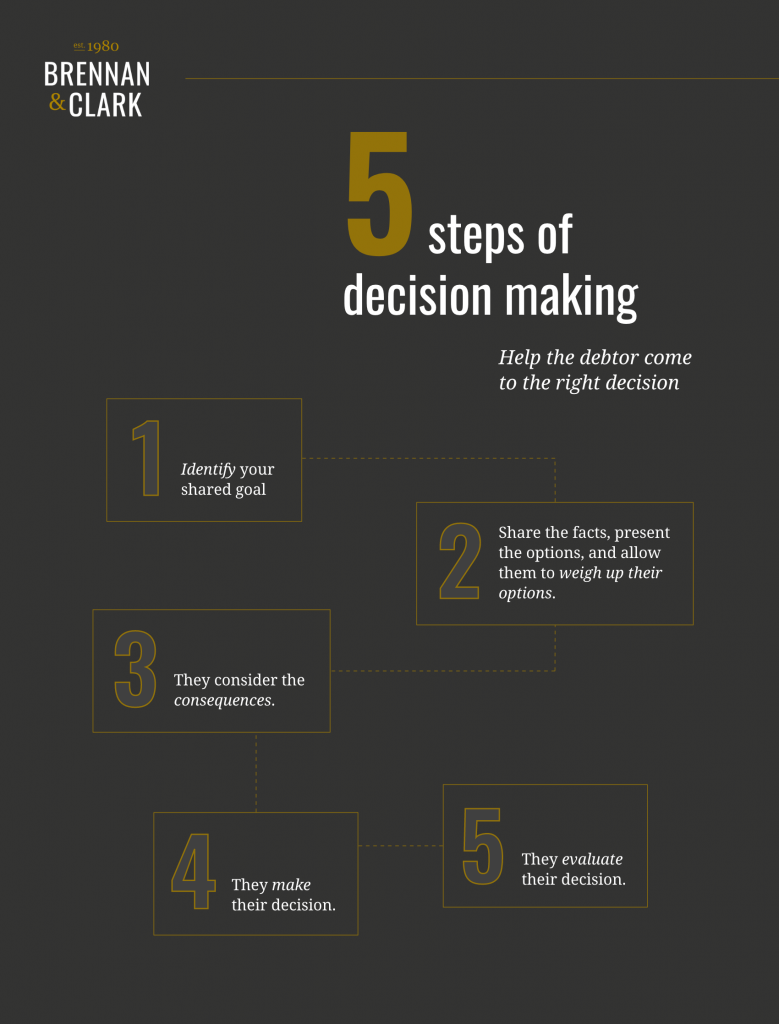

During that first contact, many debtors will deny the debt and can become hostile or aggressive. An inexperienced collector may find themselves responding with a harsh or forceful approach. A professional negotiator, however, will remain calm and authoritative. Rather than engaging emotionally, concentrate on the following five-step strategy.

Step one is to identify your shared goal. Namely for you to collect the balance due and for them to avoid further escalation of consequences.

Step two is to share the facts. Ensuring you have the full information at hand before you make the first call helps you stay in control. Briefly present the choices they face and allow them to consider their options.

Next, encourage them to consider the consequences. A successful negotiator will convince them that inaction is the most damaging option.

Step four is to urge the debtor to take control of the situation and make a decision.

Finally, help the debtor to evaluate their choice and feel positive about the outcome.

By understanding the psychology of the debtor, we can see that in the first instance, they will often be feeling stressed and hostile. Instead of reacting to these emotions, an effective negotiator will channel them as quickly as possible into a sequence of decisions.

By offering clear choices to make, we restore the debtor’s sense of control over the situation. Guiding them towards a constructive decision about which they can feel positive.

For detailed advice on negotiating strategy or improving your commercial collections generally, give us a call and speak to our experts. Or download our free guide to Mastering the Art of Collections.