Home / News & Insights / August 25, 2021 / ...

The Importance of Listening on Debt Collection Calls

Rather than talking, or debating, with debtors, an expert collector spends most of their time on debt collection calls listening to discover the real facts of the situation hidden between the words.

Broadly speaking, people are terrible listeners. We can comprehend facts much faster than we can speak, which means that when someone is talking, our minds often wander. Instead of really listening to the speaker, we focus on counter arguments or planning what to say next. As a collector, this means you may miss what the debtor is truly saying – both explicitly and between the lines.

When speaking with debtors on the phone, an ability to listen actively and attentively is one of the greatest skills you bring to the table. Let the debtor reveal their story, the justifications, objections, and extenuating circumstances. Somewhere, hidden among the words, are important facts that will help you facilitate a resolution.

In short, an expert negotiator will spend 80 percent of their time listening and just 20 percent talking. But it’s not simply a case of keeping silent – an active listener will encourage the debtor to open up, ensuring they are more likely to engage.

Eliminate negative listening habits

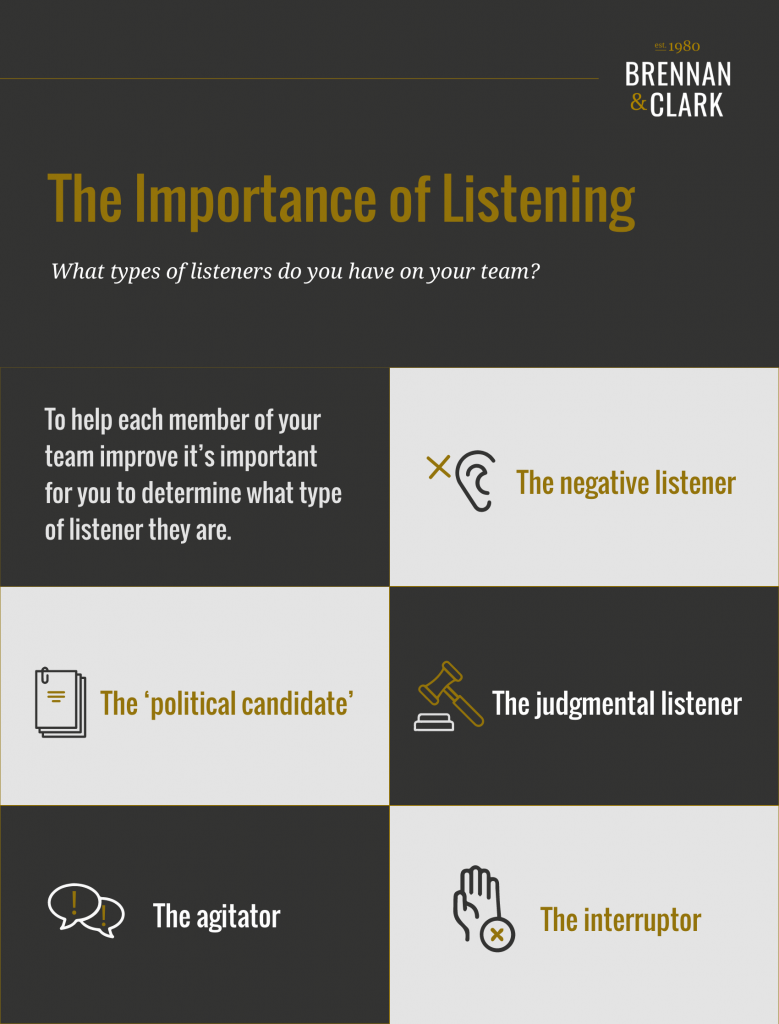

To enhance your listening skills during debt collection phone calls, it can be useful to identify what type of listener you are and eradicate any bad habits. Negative listeners, for example, fail to find anything positive in what the speaker has said. Instead, this type of listener will persist in finding flaws and counter arguments, eventually stifling conversation entirely.

Similarly, the agitator who instantly or aggressively refute every one of the debtor’s points are unlikely to reach a successful outcome. Debtors may stretch the truth, but immediate rebuttal can exacerbate their claims. Instead of focusing on disproving their words, listen carefully to the detail and invite them to elaborate with further evidence. Keep the burden of proof on their facts and avoid agitating them to the point where they become uncooperative.

Serial interrupters can provoke a similar response. Cutting the debtor off mid-flow or interjecting prematurely can irritate them and may mean you miss vital details. Resist the temptation to respond immediately to everything the debtor says, opting instead for patient, measured, responses and well-timed pauses to improve the flow of conversation and elicit more information.

Other common pitfalls that characterize a negative approach include the judgmental listener; someone who can’t resist pointing out the debtor’s errors. In most cases, the debtor is well aware that their lack of prudence has gotten them into this situation, and they won’t thank you for reminding them. In order to facilitate a resolution, collectors should remain objective and listen without passing comment.

Finally, despite the risks described above, don’t stick rigidly to a pre-written script like a political candidate. Although a script can help to organize your thoughts, an inflexible approach will reduce your ability to pick up on the nuances of the debtor’s situation. Rather than repeating words you planned beforehand, repeat back what the debtor has just explained. This is a far more effective strategy, proven to promote open dialog.

Employ positive listening strategies

Firm, fair, and constructive negotiation depends on active listening skills. Just as negative listeners can stifle conversation, positive listeners will make it flow. By confirming that you have understood what has been said, a skilled collector can encourage debtors to acknowledge there is a balance to pay and guide them towards a resolution.

Remember, people are more likely to believe words they have spoken themselves, so once they have finished speaking, repeat back what the debtor has told you. Use open ended questions to invite more detail and avoid cutting the other speaker off mid flow. Validating statements can also help the conversation to flourish; use active cues such as “Why do you say that?” or “Tell me more about that” to elicit a more open response.

In utilizing these strategies, the skilled negotiator positions themselves as an impartial and objective facilitator, ready to help the debtor find a solution to their predicament so they can move on proactively. Bear in mind, a successful outcome depends on respectful negotiation – ensuring you collect all that can be collected, while still protecting client relationships.

For more tips on promoting positive negotiation, encouraging debtors to engage, and maximizing collections, download our free guide to Mastering the Art of Collections, or contact our experts directly to see how we can help you maximize your collections.