Once I place an account, I’m confident they will deliver and recover the money with no further chasing from me

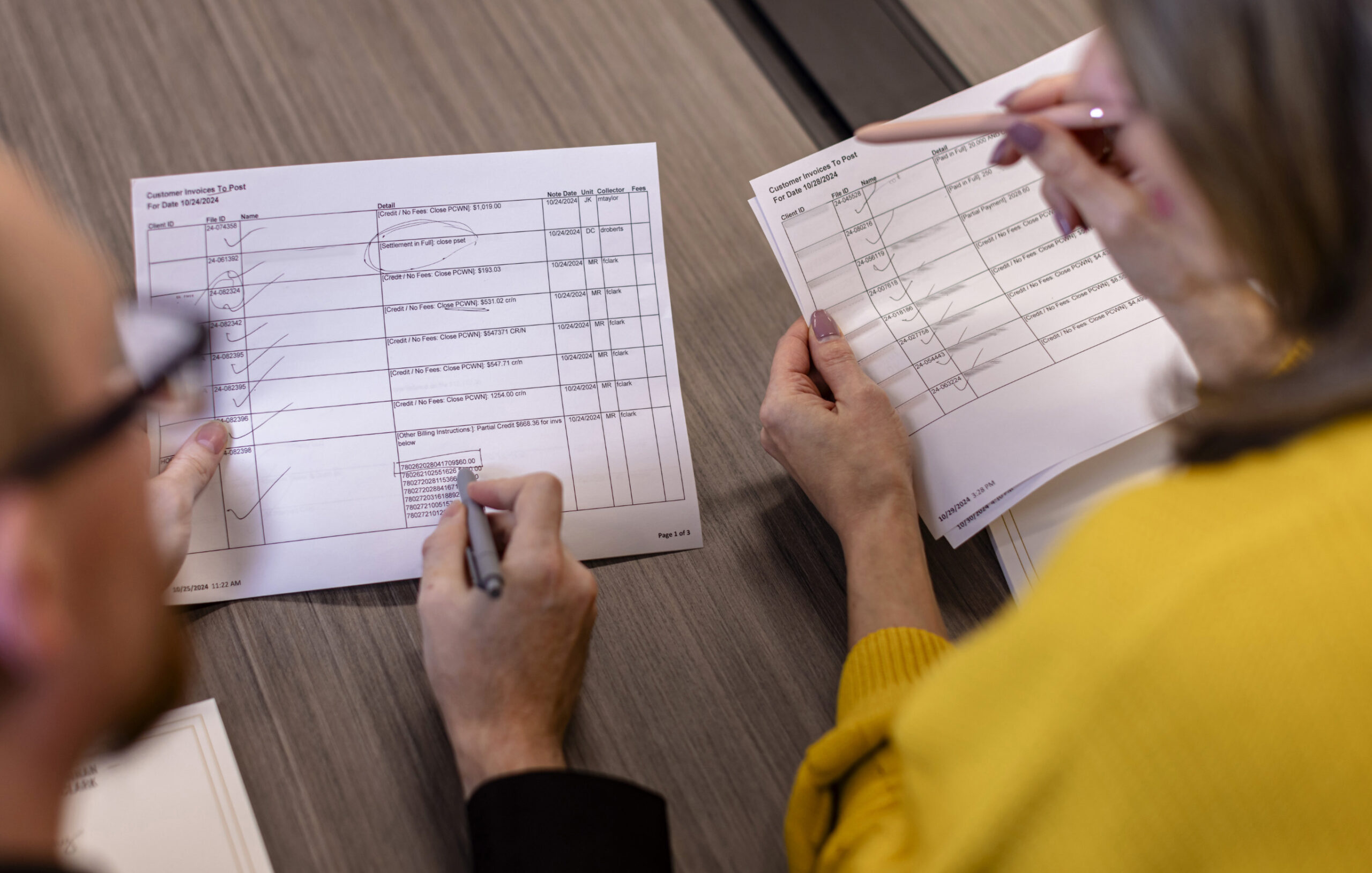

“Regular monthly and quarterly reports are sent out to us routinely, tailored to meet our needs. And when I request more specific data, Brennan & Clark are always able to provide it right away and, if it’s a custom report, I’ve never waited more than 48 hours.

When my CFO, for example, wants to see more data, or needs additional information, Brennan & Clark always comes through and provides me with that additional detail. I never have to chase reports and whenever I call, they come back with answers really quick, so we can make effective financial decisions based on fact.

If we have a query, even Meg Scotty, Brennan & Clark’s CEO, has been known to get involved and help us, so I would say their customer service is exceptional.

Brennan & Clark always deliver reliable results. Once I place an account with them, I’m confident they will deliver and recover the money with no further chasing from me.

We used to recover around $150k a year, Brennan & Clark increased that to $2 million in just one year, and in 2020 we recovered a total of $9.6 million.”